Buying a home is a significant milestone, but for many, the thought of saving for a down payment can feel overwhelming. However, if you’re a veteran, active-duty service member, or eligible family member, you have access to a unique and powerful tool: VA benefits. The Department of Veterans Affairs (VA) offers loans that allow qualified individuals to purchase a home with no down payment, making homeownership more accessible than ever.

What Are VA Loans?

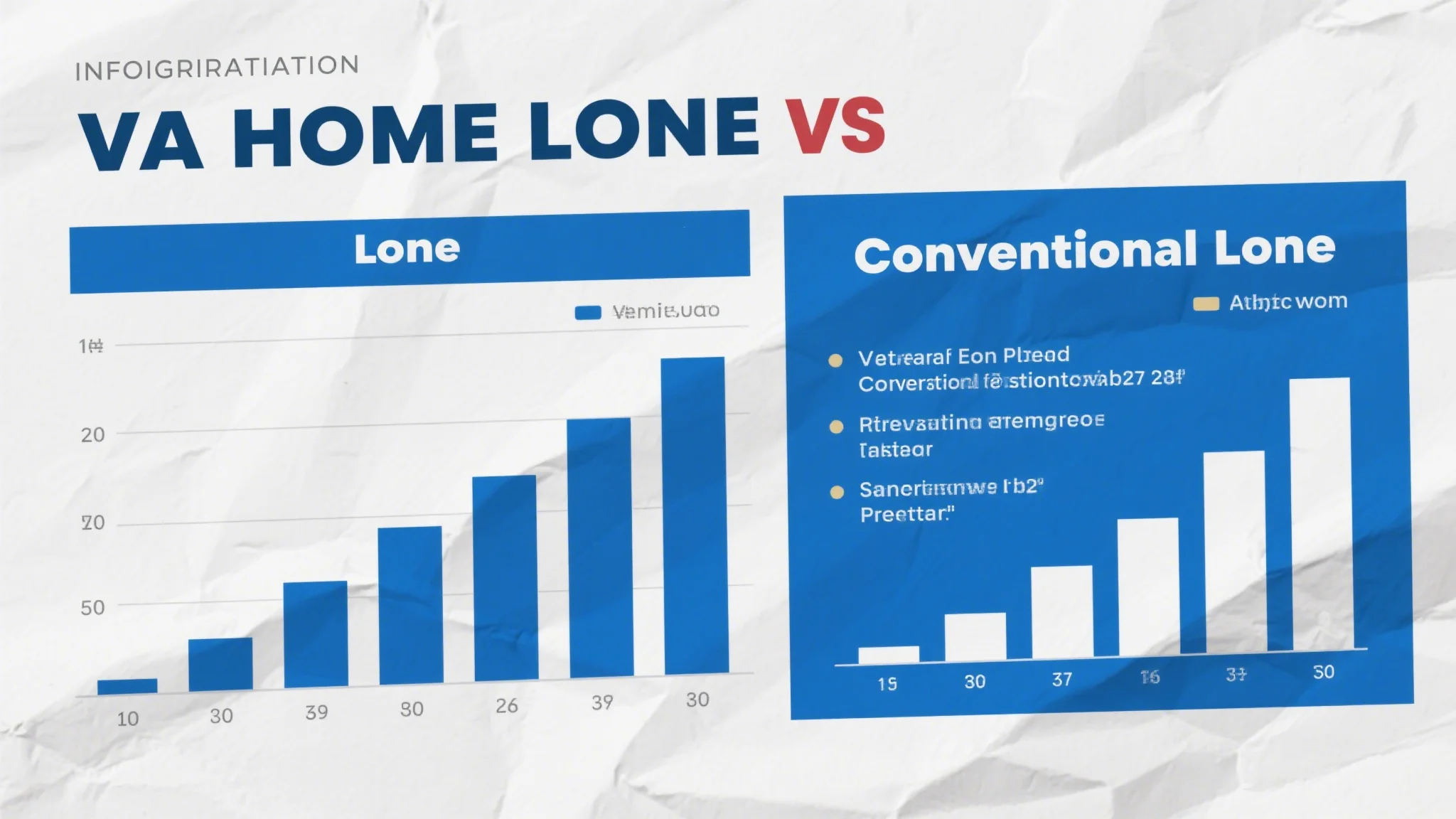

VA loans are government-backed mortgages designed to provide financial assistance to veterans and their families. These loans are guaranteed by the VA, which means lenders are protected against losses if borrowers default. This guarantee makes VA loans a popular choice among lenders, who are often willing to offer more favorable terms compared to conventional loans.

One of the most attractive features of VA loans is the ability to buy a home with no down payment. Unlike traditional mortgages, which typically require a down payment of 3% to 20% of the home’s value, VA loans allow you to finance 100% of the purchase price. This benefit alone can make a significant difference in your ability to afford a home.

Who Is Eligible for VA Loans?

VA loans are available to eligible veterans, active-duty service members, and certain family members. To qualify, you must meet specific criteria set by the VA:

Military Service: You must have served on active duty, in the National Guard, or in the Reserves for a specified period. The exact requirements vary depending on the branch of service and era of service.

Discharge Status: You must have received an honorable discharge or general discharge under certain conditions.

Residency: You must be a U.S. citizen or a qualified non-citizen.

Creditworthiness: You must demonstrate the ability to repay the loan, which includes having a stable income, good credit score, and manageable debt-to-income ratio.

If you’re unsure about your eligibility, the VA provides tools and resources to help you determine whether you qualify.

Benefits of Using VA Benefits for Homeownership

The benefits of using VA loans extend beyond the no-down-payment feature. Here are some additional advantages:

Low Interest Rates: VA loans often come with competitive interest rates, which can save you money over the life of the loan.

No Private Mortgage Insurance (PMI): Since the VA guarantees the loan, you won’t need to pay PMI, which can reduce your monthly mortgage payments.

Flexible Credit Requirements: VA loans have more flexible credit and income requirements compared to conventional loans, making them accessible to a wider range of borrowers.

Assistance with Closing Costs: The VA allows lenders to include closing costs in the loan amount, meaning you don’t have to pay them out of pocket.

These benefits make VA loans an excellent option for those looking to achieve the American Dream of homeownership without the burden of a significant down payment.

How to Get Started

If you’re ready to take the next step, here’s how to begin the process of using VA benefits to buy a home:

Determine Your Eligibility: Visit the VA website or contact a local VA office to verify your eligibility. You’ll receive a Certificate of Eligibility (COE), which lenders require to process your loan application.

Work with a VA-Approved Lender: Not all lenders offer VA loans, so it’s important to work with a VA-approved lender. These lenders are familiar with the VA loan process and can guide you through each step.

Pre-Qualify for a Loan: Many lenders offer pre-qualification, which allows you to determine how much you can afford before you start shopping for a home. This can also help you negotiate better terms with sellers.

Shop for a Home: Once you’re pre-qualified, you can begin exploring homes in your price range. Be sure to work with a real estate agent who has experience with VA loans, as they can help you navigate the process smoothly.

Lock in Your Rate: Once you find a home you want to buy, you’ll need to lock in your mortgage rate to ensure it remains favorable during the closing process.

By taking these steps, you’ll be well on your way to securing a VA loan and purchasing a home with no down payment.

Understanding the VA Loan Process

The VA loan process is designed to be straightforward, but it’s important to understand each step to avoid delays or complications. Here’s a breakdown of what you can expect:

Application Submission: After pre-qualifying, you’ll submit a formal loan application to your VA-approved lender. This typically involves providing documentation such as pay stubs, tax returns, and bank statements to verify your financial status.

Underwriting: The lender will review your application to assess your creditworthiness and ensure you meet the VA’s requirements. This step may take several weeks, depending on the complexity of your situation.

Appraisal: The lender will order an appraisal of the property to determine its market value and ensure it’s a sound investment. The appraisal fee is often included in the closing costs.

Closing: Once all conditions are met, you’ll close on the loan and purchase the home. At this point, you’ll sign the necessary documents and transfer ownership.

Additional Tips for Success

To make the most of your VA loan, consider the following tips:

Shop Around for Lenders: Different lenders may offer varying terms and fees, so it’s important to shop around to find the best deal.

Communicate with Your Lender: Keep your lender informed of any changes in your financial situation, as this could affect your loan approval or terms.

Plan for Closing Costs: While VA loans allow you to finance closing costs, it’s still a good idea to budget for them to avoid surprises.

Take Advantage of VA Resources: The VA offers a variety of resources to help you through the homebuying process, including workshops, counseling services, and online tools.

The Emotional and Financial Impact of Homeownership

Owning a home is more than just a financial investment—it’s a symbol of stability and success. For veterans and military families, the ability to purchase a home with no down payment using VA benefits can be a lifeline, offering a sense of security and pride.

Financially, homeownership can also be a smart investment. Over time, home values tend to appreciate, and the equity you build can be a valuable asset. Additionally, the tax benefits of owning a home, such as deductions for mortgage interest and property taxes, can further reduce your financial burden.

Using VA benefits to buy a home with no down payment is a powerful way to achieve the dream of homeownership. With the right guidance and preparation, you can navigate the VA loan process confidently and secure a home that meets your needs and budget.

If you’re a veteran, active-duty service member, or eligible family member, don’t let the cost of a down payment stand in your way. Explore your VA loan options today and take the first step toward becoming a homeowner. Your future self will thank you for this wise investment in your family and your future.

This concludes the article. Let me know if you need further adjustments!