When it comes to financing a home, veterans have access to special loan programs designed to make homeownership more accessible and affordable. Two of the most popular options are the VA Home Loan and the Conventional Loan. While both are viable choices, they cater to different needs and financial situations.

What is a VA Home Loan?

The VA Home Loan, or Veterans Affairs Loan, is a mortgage option available to eligible military service members, veterans, and their families. This loan is guaranteed by the Department of Veterans Affairs (VA), which means lenders are protected against losses if the borrower defaults. This government backing allows VA loans to offer unique benefits, such as no down payment, flexible credit score requirements, and competitive interest rates.

One of the standout features of a VA Home Loan is the absence of a down payment. This makes it an ideal choice for veterans who may not have saved enough for a down payment but still want to purchase a home. Additionally, VA loans typically require lower credit scores compared to conventional loans, making them more accessible to individuals with less-than-perfect credit histories.

Another advantage of the VA Home Loan is the ability to finance up to 100% of the home’s value, which is a significant benefit for first-time homebuyers or veterans with limited savings. However, it’s important to note that VA loans are only available for primary residences and have maximum loan limits, which vary by county.

What is a Conventional Loan?

A Conventional Loan is a private mortgage loan that is not backed by any government agency. These loans are offered by banks, credit unions, and other financial institutions, and they are subject to the lender’s specific criteria. Conventional loans are the most common type of mortgage in the United States, and they come in two forms: Fixed-Rate and Adjustable-Rate (ARM).

One of the key benefits of a Conventional Loan is the variety of options available to borrowers. For example, a fixed-rate mortgage offers stable payments over the life of the loan, while an ARM offers lower initial rates that adjust over time. Conventional loans also allow for higher loan amounts, making them a suitable option for those looking to purchase more expensive properties.

However, Conventional Loans do require a down payment, typically ranging from 3% to 20% of the home’s value, depending on the borrower’s credit score and down payment. They also have stricter credit score requirements compared to VA loans, with most lenders requiring a minimum score of 620 for a conventional loan.

Choosing Between VA and Conventional Loans

For veterans, the decision between a VA Home Loan and a Conventional Loan depends on several factors, including financial stability, credit history, and short-term versus long-term goals.

Financial Stability: If you have a stable income and a strong credit score, a Conventional Loan might offer more flexibility and potentially lower interest rates over time. However, if you’re still building your credit or have limited savings, a VA Home Loan could be a better option due to its lenient requirements and no-down-payment feature.

Down Payment: If you have the funds for a down payment, a Conventional Loan could save you money on interest over the life of the loan. On the other hand, a VA Home Loan’s no-down-payment feature can be a game-changer for those who are unable to save for a down payment upfront.

Loan Limits: VA loans have maximum loan limits, which can be a limiting factor for those looking to purchase high-priced homes. Conventional loans, however, offer higher limits, making them a better fit for expensive properties.

Interest Rates: VA loans often come with lower initial interest rates due to their government backing, but this can vary depending on market conditions. Conventional loans may offer competitive rates as well, especially for borrowers with excellent credit scores.

In the end, the best choice depends on your unique financial situation and long-term goals. If you’re unsure which loan is right for you, consider consulting with a mortgage professional who can provide personalized advice and help you navigate the complexities of the home loan process.

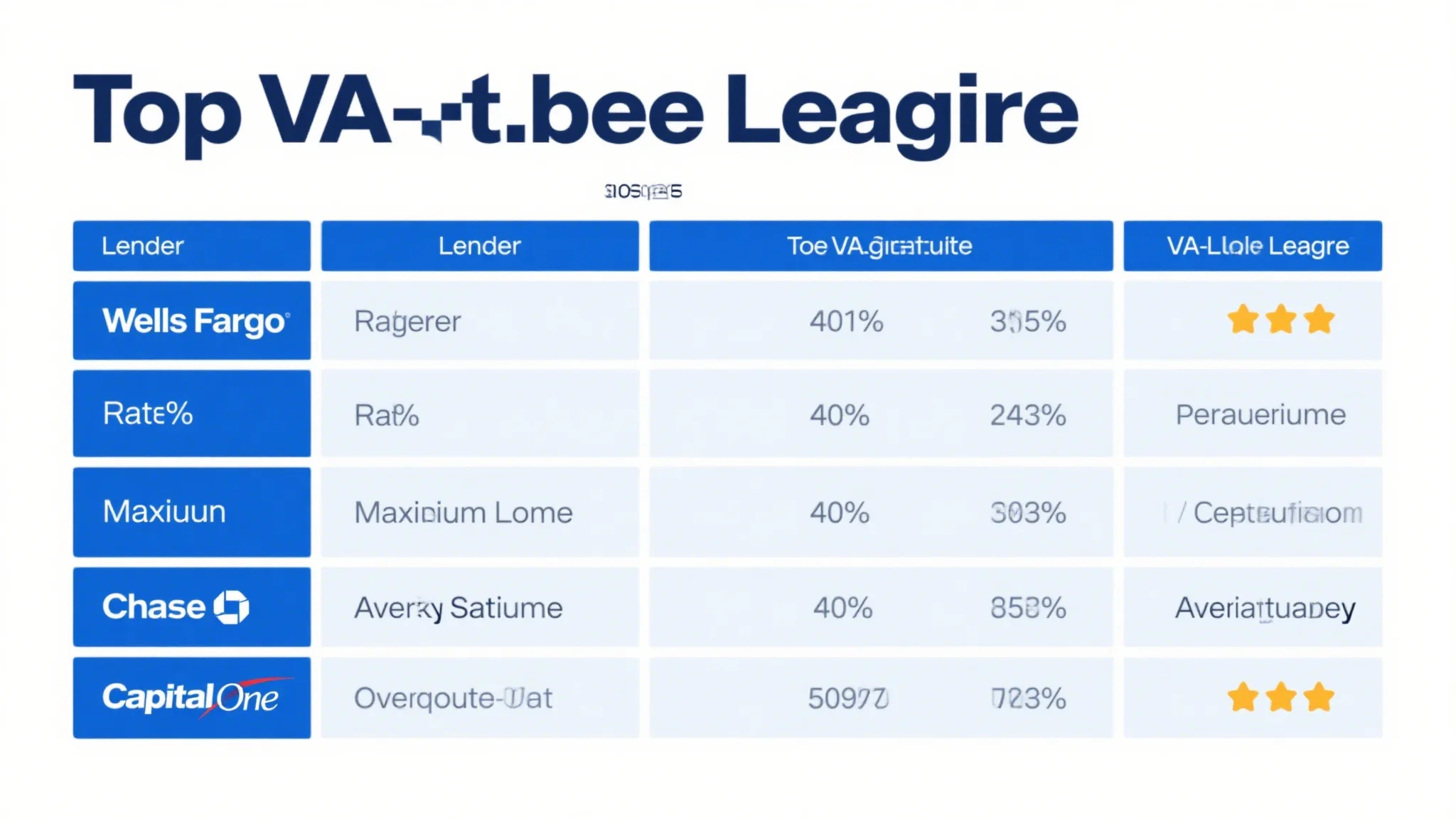

VA Home Loan vs Conventional Loan: A Side-by-Side Comparison

To help veterans make an informed decision, let’s break down the key differences between VA Home Loans and Conventional Loans:

1. Eligibility Requirements

VA Home Loan: Open to eligible military service members, veterans, and their surviving spouses. No down payment required, and credit score requirements are more flexible.

Conventional Loan: Available to all qualified borrowers, regardless of military status. Requires a higher credit score and a down payment.

2. Down Payment

VA Home Loan: No down payment required.

Conventional Loan: Typically requires a down payment of 3% to 20%.

3. Interest Rates

VA Home Loan: Often comes with lower initial interest rates due to government backing.

Conventional Loan: Interest rates can be competitive, especially for borrowers with excellent credit scores.

4. Loan Limits

VA Home Loan: Has maximum loan limits, which vary by county.

Conventional Loan: Offers higher loan limits, making it suitable for expensive properties.

5. Mortgage Insurance

VA Home Loan: No mortgage insurance required.

Conventional Loan: Requires mortgage insurance if the down payment is less than 20%.

6. Flexibility

VA Home Loan: Limited to primary residences and comes with specific use restrictions.

Conventional Loan: Offers more flexibility, including options for fixed-rate and adjustable-rate mortgages.

Which Option is Right for You?

For veterans, the decision between a VA Home Loan and a Conventional Loan hinges on your financial situation, goals, and priorities. If you’re looking for a no-down-payment option with flexible credit requirements, the VA Home Loan is likely the better choice. On the other hand, if you have the funds for a down payment and are aiming for a higher loan amount, a Conventional Loan might be more suitable.

It’s also worth considering the long-term implications of each loan. For example, while a VA Home Loan may have lower initial interest rates, a Conventional Loan could save you money over time if you’re able to secure a lower rate with a larger down payment.

Final Thoughts

Choosing the right home loan is a significant decision that can impact your financial future. Veterans have unique advantages when it comes to financing a home, and it’s essential to explore all options carefully. Whether you opt for a VA Home Loan or a Conventional Loan, make sure to work with a trusted mortgage professional who can guide you through the process and help you find the best fit for your needs.

By understanding the differences between these two loan types and evaluating your personal circumstances, you can make a confident decision that sets you on the path to homeownership.

This concludes the article. Let me know if you need further adjustments!